what is suta tax rate for california

The California Employment Development Department has confirmed that unemployment tax rates are unchanged for 2022 on its website. The amount of the tax is based on the employees wages and the states unemployment rate.

Payroll Tax Requirements Windes Pages 1 7 Flip Pdf Download Fliphtml5

According to the EDD the 2021 California employer SUI tax rates continue to range from 15 to 62 on Schedule F.

. What is the SUTA tax rate for 2021. There is no taxable wage limit. The SUI taxable wage base for 2021 remains at 7000 per employee.

State unemployment tax rates. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction.

To calculate your SUTA tax as a new employer multiply your states new employer tax rate by the wage base. The new employer SUI tax rate remains at 34 for 2021. Arizona California Florida Georgia and Tennessee had the lowest wage bases at 7000.

What is the SUTA tax rate for 2021. When a low rate is obtained payroll from another entity with a high UI tax rate is shifted. As a result of the ratio of the California UI Trust Fund and the total wages paid.

When it comes to SUTA tax employers should know about the SUTA tax wage base and state unemployment tax rates. According to the EDD the 2021 California employer SUI tax rates. Lets say that your tax rate the percentage you pay on the wage base limit is 5 and you have 3 employees.

2021 SUI tax rates and taxable wage base. As a result of the ratio of the California UI Trust Fund and the total wages paid. What is California SUTA tax rate.

State unemployment tax is a percentage of an employees. California PIT is withheld from employees pay based on the Employees Withholding Allowance Certificate Form W-4 or DE 4 on file with their employer. SUTA dumping is a tax evasion scheme where shell companies are set up to get low UI tax rates.

The states SUTA wage base is 7000 per. According to the EDD the 2021 California employer SUI tax rates. The new employer SUI tax rate remains at 34 for 2021.

State SUTA new employer tax rate Employer tax rate range. Each state sets a SUTA tax wage base for. 52 rows Most states send employers a new SUTA tax rate each year.

Effective January 1 2022. For example the wage base limit in California is 7000. SUTA or the State Unemployment Tax Act is a tax that employers pay on employee wages.

Economy Of California Wikipedia

View All Hr Employment Solutions Blogs Workforce Wise Blog

San Jose Leads Jobs Increase As California Unemployment Rate Falls To 11

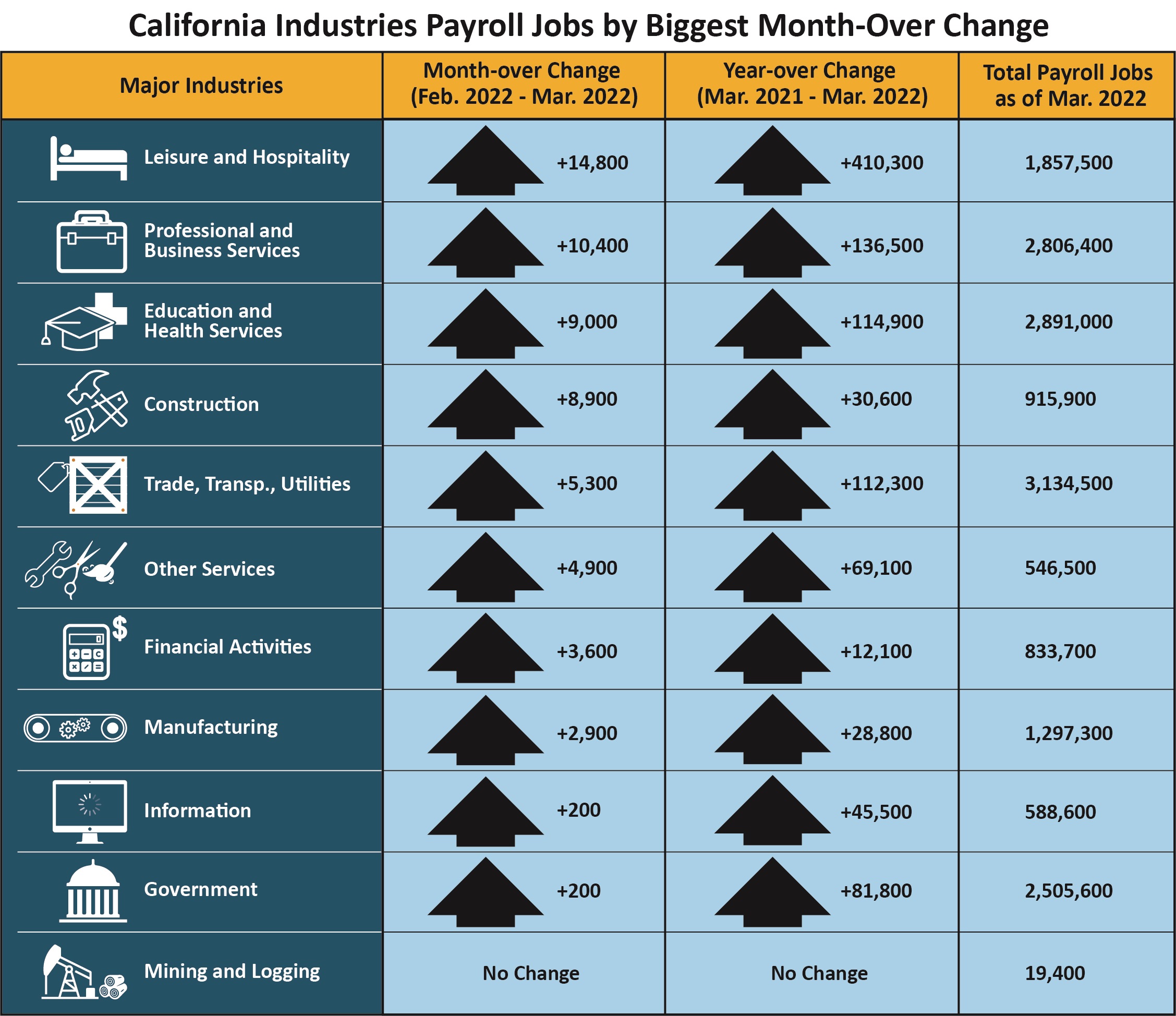

California S Unemployment Falls To 4 9 Percent For March 2022

Understanding The Governor S 2022 23 May Revision California Budget And Policy Center

California Unemployment Rate 2021 Statista

Unemployment Rate In California Caur Fred St Louis Fed

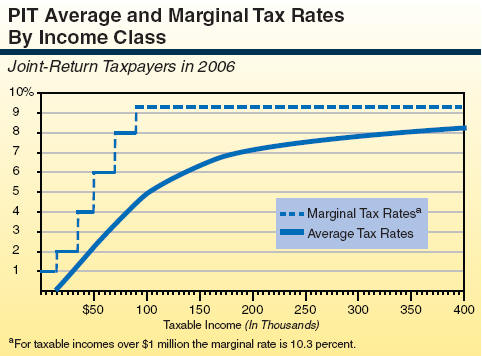

California S Tax System A Primer

The Income Gap Unemployment And Tax Rates Visual Ly

California Tax Rates Rankings California State Taxes Tax Foundation

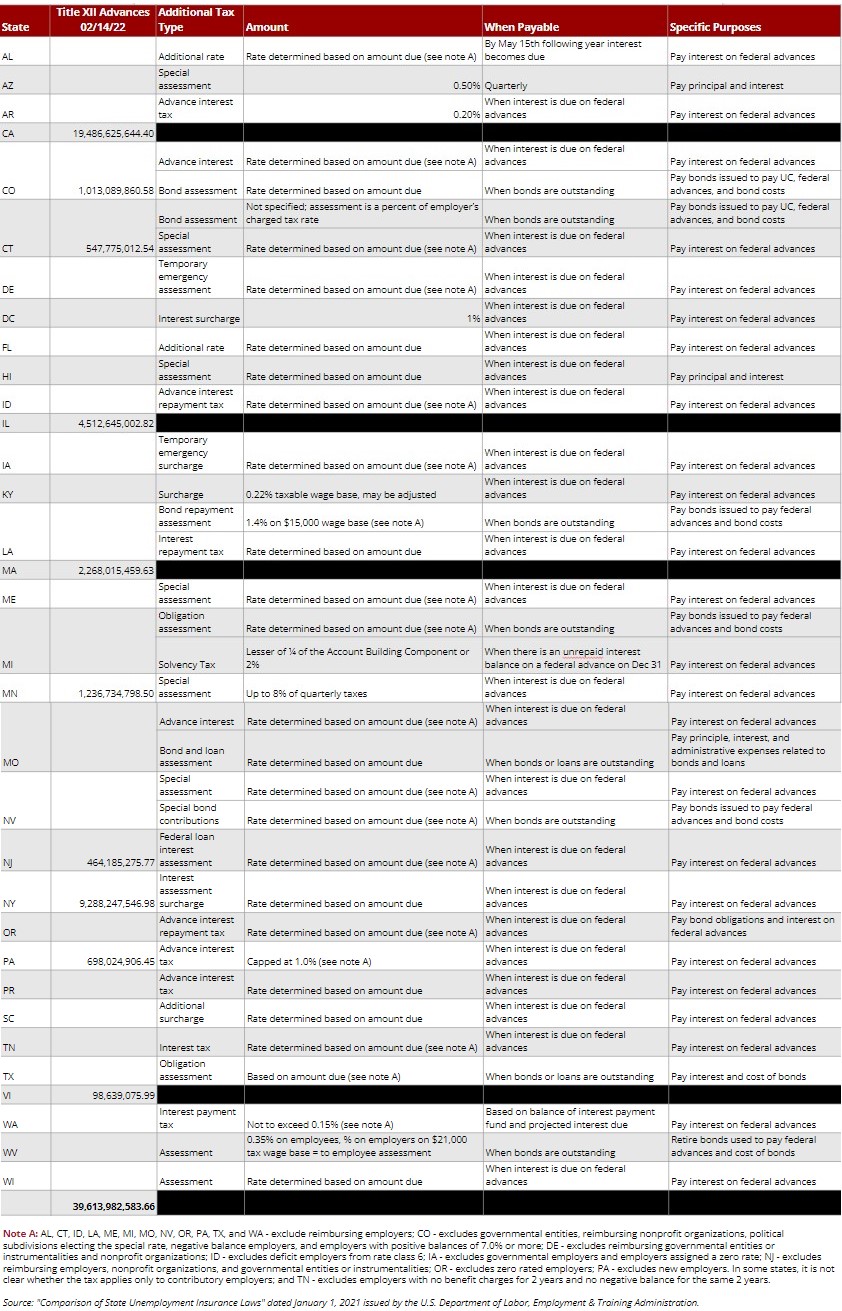

Overdue Why California Needs To Reform Unemployment Insurance Funding Stanford Institute For Economic Policy Research Siepr

View All Hr Employment Solutions Blogs Workforce Wise Blog

Martini Akpovi Partners Cpas A California Spokesperson From The Ca Employment Development Dept Edd Reveals 2021 Unemployment Tax Rate Details The Unemployment Tax Rate Which Includes A 15 Emergency Surcharge Based

What Is Sui Tax And How Do I Pay It Hourly Inc

Update Ui Ett Rates California Employer Candus Kampfer

Taxes On Unemployment Benefits A State By State Guide Kiplinger

Historical Eitc Data And Unemployment Rates In California Download Table